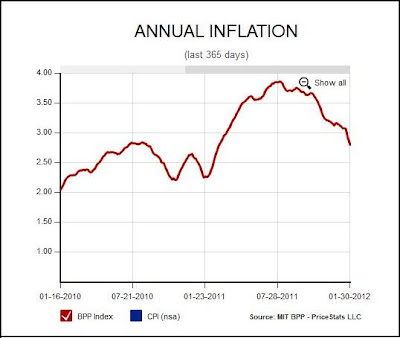

BPP@MIT Data Show Inflation Trending Downward

The Billion Prices Project @ MIT just updated its daily online price index through the end of January 2012, and the annual inflation rates from that index are displayed in the graph above. After peaking at close to 4% in the one-year period through the end of July 2011, the annual inflation rate from the BPP @ MIT daily price index has been trending downward, and the current rate is about 2.75%, the lowest annual inflation in almost a year.

According to this real-time, daily measure of retail price changes across multiple categories and retailers, inflationary pressures in the U.S. economy have been moderating over the last six months, and annual inflation was below 3% for multiple days at the end of January for the first time since last March.

According to this real-time, daily measure of retail price changes across multiple categories and retailers, inflationary pressures in the U.S. economy have been moderating over the last six months, and annual inflation was below 3% for multiple days at the end of January for the first time since last March.

49 Comments:

For the life of me, I have no idea how one defines inflation based off of prices in any reasonable way. Gas goes up, electronics go down -- who determines which has more weight?

I thought inflation was simply an increase in the supply of money.

sure, it ignores food, energy, healthcare, and education, the thinks driving this inflation.

BPP should read even lower than core.

it's predominantly consumer electronics, the most deflationary space on earth.

also note:

even the year to year data is seasonal.

we saw this same pattern last year.

yoy prices dropped from july to feb, then exploded to new highs during the peak inflation season of mar-july.

i would not bet against that happening again this year, especially in food and energy which are showing signs of getting nasty again.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/02/21/MNDU1N8L6M.DTL

http://www.investmentu.com/2011/February/5-dollar-gasoline.html

gasoline is already at an all time high for this time of year.

hp-

well, ideally you look at the amount of consumption of a given product and weight it as % of overall consumption or of GDP.

in practice, the BLS goes far out of its way not to do so.

it weights healhcare at roughly half its share of GDP as an example and thereby understates the increase in price rise of the typical consumer basket.

http://www.bls.gov/cpi/cpid1201.pdf

you can see the weightings there.

housing is also a really tricky one as "owner equivalent rent" is hideously complex.

they also tend to deeply underweight rental costs and overstate home ownership.

rent has about 1/4 the weighting in cpi of home ownership, but the ratio of renters to owners is more like 2 to 3.

getting such a basket right is incredibly difficult, but i get the sense the BLS is not even trying and instead seeking to twist the numbers to get a desired result.

i do not think it is a coincidence that sectors like rent and healthcare that have such high inflation are getting so underweighted.

The Chicken Inflation Littles are not only wrong in their fears, but doubly so.

1. Inflation is very low, in fact deflation is the risk

2. Moderate inflation for several years would be salubrious to the economy, aid with deleveraging, and reflate real estate, thus helping banks and lenders.

3. Moderate inflation, by reducing the national debt, would help our wealthy, who are the main income tax payers. It is the wealthy who will have to pay off the huge national debt. If we moderately inflate for several years, that burden will be reduced. If the GOP can figure this out, they will start to sing the praises of inflation.

"1. Inflation is very low, in fact deflation is the risk"

repeating that over and over will not make it true benji.

US deflation?

you have to be joking.

and your evidence for this outlandish viewpoint is what?

"3. Moderate inflation, by reducing the national debt, would help our wealthy, who are the main income tax payers"

first off, i hesitate to even ask what you call "moderate inflation' given that you think this is deflation. second, speak as one you claim this will help, we disagree.

inflation is a tax on savings. it hurts more than helps.

further, give that half the problem in the US is that our savings rates are too low, this keynisan nonsense about needing to drive consumption is precisely what we do not need.

that's what got us into so much debt in the first place and made this mess over a decade of no growth in real per capita GDP.

the policies you champion have been failing for 12 years benji, wake up and smell what you are shoveling. they are the problem, not the solution.

you have mistaken the brake for the gas and just keep claiming we'll speed up if you just stomp on it harder.

The Chicken Inflation Littles are not only wrong in their fears, but doubly so.

I agree. As I said before, the inflation nuts are just former peak oil nuts looking for something else to build a Malthusian cult around.

BPP is the broadest and most accurate gauge of inflation around, and cannot be 'rigged'.

"BPP is the broadest and most accurate gauge of inflation around, and cannot be 'rigged'."

nonsense.

BPP is nothing like broad nor accurate. it uses unweighted internet prices. the basket has no relation to consumption at all. it massively overweights consumer electronics.

further, internet prices are the most competitive in the world, thus show less inflation that physical retail, which is most of consumption.

it also almost entirely excludes healthcare, rent, home prices, food, energy, and most services.

buy a lot of gasoline online do you?

far from being the most complete, it's one of the narrowest in addition to being the most completely misweighted.

you need to take a serious look at how this index is calculated KMG, because you have the utterly wrong idea about it.

I just love how the ones trying to skewer the "Chicken Inflation Littles" have nothing other than assertions and attacks, and when confronted with actual facts about things like the massive shortcomings in the BPP or CPI just simply ignore them... in obsessive ostrich mode.

CPI and BPP separate out energy not to hide their contributions, but rather because the energy market (oil specifically) is mainly monopoly controlled. Regardless of US monetary or fiscal policy, regardless to money supply, the price of oil can be whatever the oil cartel's want it to be. Consumer electronics can not do this. Auto makers can not do this. Home sellers can not do this. Buyers in these markets can see their dollar go quite far, thus the low inflation number.

This aspect of oil severely distorts any measure of the economy on a whole, and therefor needs to be analyzed separately.

I am pretty sure that the BPP price index DOES include food prices based on this description from its website, "Our data include information on product descriptions, package sizes, brands, special characteristics (e.g. “organic”), and whether the item is on sale or price control."

Also, it can't be predominantly consumer electronics, because the BPP price level has risen slightly higher than the CPI index since 2008. And for most of 2010 and part of 2011, the BPP annual inflation rate was HIGHER than the CPI inflation, in some periods by a LOT: 3% BPP inflation vs. 1% CPI inflation in July 2010.

If anything, the BPP measure might overstate inflation vs. the CPI, not understate it.

Many economists, incuding Don Boudreaux, past chairman of the econ department at George Mason (Right-Wing U), have written that the CPI overstates inflation.

See here:

http://www.pittsburghlive.com/x/pittsburghtrib/s_425055.html

If you get any more right-wing than Don, you have arm spasms when you hear martial music.

In general, the CPI overstates inflation by perhaps 1 percent.

From 2008 to 2011, annual averages, inflation was up 1.5 percent.

Ergo, we are very close to deflation.

And what I said is true: If the wealthy have to pay off the national debt, they will benefit when inflation pays off some of the debt.

Of course, you could argue that the middle-class should pay off the national debt. See GOP tax policies.

Quote from Mark Perry: "If anything, the BPP measure might overstate inflation vs. the CPI, not understate it."

Both measures are completely arbitrary and without meaning in reality. You might as well be arguing about how many angels can fit on the head of a pin.

The central banks are constantly expanding the currency supply, so inflation is inherent. When people start destroying money, we can start talking about deflation.

Quote from Mark Perry: "If anything, the BPP measure might overstate inflation vs. the CPI, not understate it."

Both measures are completely arbitrary and without meaning in reality. You might as well be arguing about how many angels can fit on the head of a pin.

The central banks are constantly expanding the currency supply, so inflation is inherent. When people start destroying money, we can start talking about deflation.

The effects of increased money supply are dramatically overstated. Growing economies need a growing money supply.

Referencing back to 1971 the US population has increased by about 100,000,000. The World population (which also heavily relies on the dollar) has increased over 3,000,000,000. Productive capacity has thus increased as well as efficiencies in bringing disconnected markets together. It would only make sense that the money supply increases more or less proportionally to fit the productive capacity of the economy.

Why Broll--

Intelligent commentary.

See Japan for a nation that has tried the opposite approach. It is disaster.

mark-

"I am pretty sure that the BPP price index DOES include food prices based on this description from its website, "Our data include information on product descriptions, package sizes, brands, special characteristics (e.g. “organic”), and whether the item is on sale or price control."

it includes them, but in a very small proportion in comparison to actual consumption, which was my point.

the weighting on BPP is way off. the basket they wind up with has no real relation to the consumption basket of consumers.

"Also, it can't be predominantly consumer electronics, because the BPP price level has risen slightly higher than the CPI index since 2008."

that is not true. bpp has no hedonic quality adjustments.

take those out and CPI would be up quite a bit more. i see what you are trying to say, but i do not think it's a valid comparison.

you can see what that looks like by looking at the import/export price changes produced by the census bureau which have often been in double digits lately.

benji-

what a shock, an appeal to authority.

and many of the top economists and investors in the world, like volcker, bill gross, david einhorn, etc have said that CPI understates inflation.

boudreax relies on the boskin report, which is utter conjecture. there is NO empirical data in it to support its claims.

i realize you won't, but you really ought to try reading it.

it's pure subjective assumption.

i think you'd eb stunned at how flimsy its case is.

it makes the IPCC look rigorous.

Morgan-

You still rely on those cranks and crackpots at Shadowstats?

You still rely on those cranks and crackpots at Shadowstats?

Of course. How else can a former peak oil nut become an inflation nut?

So the inflation nuts say the CPI is rigged. Fine. But BPP is also rigged? Hogwash.

Inflation is 2-3%/year, in aggregate. Anyone who claims otherwise is selectively trying to focus on the few people with disproportionate healthcare costs, or who consume 4x as much oil as the average person.

This puts aside the simple reality that someone with a mortgage house actually WANTS inflation, if they know what is good for them.

Hmm.... so I have to pay another $300/year in gasoline, but my house has a net gain of +$200,000 in equity due to deflation being halted. Gee, which would I choose?

I know! I'll be an inflation nut and whine about the gas and the fact that inflation keeps my house out of negative equity!!

BPP is the broadest and most accurate gauge of inflation around, and cannot be 'rigged'.

BPP follows the Keynesian expectation that inflation affects all prices at the same time. It's a wonderful exercise in data collection and, at the same time, patent nonsense.

Three of the biggest components that effect inflation are technology or productivity, labor costs, and cost of capital.

All three indicate low inflation.

The U.S. is in a technological boom that began in 1982, while the 80 million Baby-Boomers began entering "prime-age."

Wage growth "crashed" in 1982, and has been slow since then, i.e. no wage-price spiral.

There remains a global savings glut, while U.S. firms continue to earn record-breaking profits, i.e. create huge amounts of capital through efficiencies.

The U.S. economy has been producing much more output with much fewer inputs, since 1982, and that trend accelerated even faster after 2000.

morganovich,

Devaluation is like the weather: as long as it's inevitable, you might as well lie back and enjoy it.

I am pretty sure that the BPP price index DOES include food prices based on this description from its website, "Our data include information on product descriptions, package sizes, brands, special characteristics (e.g. “organic”), and whether the item is on sale or price control."

And therein lies the biggest problem with the BPP - very limited facts and what they cover and how.

They do admit they don't cover the service sector, and medical is about 18% of GDP.

What about hedonic (and reverse hedonic) adjustments? We don't know.

Relying on an index on which we have very limited data or facts is I believe quite unwise to say the least.

And then there's the main unaddressed issue of what happens with folk on SS for a while (with CPI-W adjustments) who lose purchasing power and standard of living year after year.

The effects of increased money supply are dramatically overstated. Growing economies need a growing money supply.

If you do the research and actually adjust the stats for population growth, you'll see that world money supply continues to grow much faster than total population.

US M2 for example has grown by 37% since 2007 - WAY higher than population growth anywhere in the world. There are *lots* more examples if you look.

Benjamin:

You still rely on those cranks and crackpots at the BLS?

*yawn*

Three of the biggest components that effect inflation are technology or productivity, labor costs, and cost of capital.

Yes of course they affect it... but the bottom line is that most day to day living prices are WAY up over the last 3 or 5 or 10 or 100 years.

Even the BLS shows water/sewer/trash prices have been growing at +6%/year, energy at 30% plus in the last 3 years, and if you believe that medical only goes up 3-4%/year, then I have some great ocean front property in Idaho I can sell you.

"Funny" how no one from the "BLS or BPP is wonderful crowd" dares address the simple facts of retirees drop in standard of living, or that CPI medical share is ~6% while GDP shows about 17%.

"You still rely on those cranks and crackpots at Shadowstats?"

bunny-

have you ever considered actually attempting to educate yourself and gaining an understanding of economic issues as oppose to just lurching blindly from authority figure to authority figure and lobbing out ad hominem?

you don't have to go through life sounding like a fool and never knowing what you are talking about.

this is a choice you are making.

A good one showing BPP "issues", just using the bogus and understated CPI:

http://macromon.wordpress.com/2012/02/21/whats-inflating-in-the-u-s-consumer-basket/

"Three of the biggest components that effect inflation are technology or productivity, labor costs, and cost of capital.

All three indicate low inflation."

peak-

that's complete nonsense.

the biggest component that affects inflation is money supply.

ask zimbabwe, argentina, weimar, hungary, 70's america etc.

i have no idea where you got that idea, but you really need to revisit it. it's not just a little wrong, but outlandishly so.

""Funny" how no one from the "BLS or BPP is wonderful crowd" dares address the simple facts of retirees drop in standard of living, or that CPI medical share is ~6% while GDP shows about 17%."

or how rent (inflating strongly) gets weighted at 1:4 vs ownership when renters are more like a 2:3 ratio.

that's not a little underweighting, that's massive.

the whole basket is designed to exclude inflation. they have a harder time hiding it with food and energy, but still do quite a job.

food prices are up far more than reported.

look at the individual foods and it becomes very clear.

grains, meat, milk, coffee, it's all soaring.

i eat just like i always did, but my weekly bill is up 50-70% in 3-4 years, and food is cheaper where i live now than it was in san francisco.

Bart, my inflation rate for health care (both monthly payments and co-payments) has been zero for years (although, some years I pay more in co-payments and some years I pay less, i.e. inflation and deflation).

Morganovich, you may want to look at the Fisher equation of exchange MV = PT

Chart of M1 Money Multiplier:

http://research.stlouisfed.org/fred2/series/MULT

Morganovich, also, I suggest you start with econ 101, if you want to know something about economics.

peak-

m1?

what is this, the year 1200?

perhaps you are aware that the modern economy is a bit more complex than that?

further, the chart you post is irrelevant. it's a ratio that shows that m1 is less of the overall monetary base than it used to be.

it just means we use and hold less pure cash.

you find that surprising?

sounds like you are the one that ought to learn some basic finance before mouthing off.

M2 is growing at over 10% yoy.

it was 8.86 last jan, 9.76 this one, a 10.15% jump.

that's a helluva lot more than economic growth.

sorry kiddo, you get an F for econ 101.

you got 0 points for that answer.

Morganovich, obviously, you have a wrong answer for everything.

The steep drop in the money multiplier means there's less cash in circulation, because banks aren't lending much.

Here's a related article

M1 Money Multiplier Rolls Over – Again – Well South of 1.0

March 7, 2011

The M1 money multiplier monitors the amount of money individuals and businesses have to spend on consumption or investment… relative to the money available for banks to lend.

When the ratio is less than “1,” it implies banks aren’t lending as much as they could and/or folks have less to spend on things that would increase economic activity.

As you can see from the chart, the reservoir is low. Money is still not moving through the economy swiftly or broadly among sectors. You can take all the dire warnings of inflation and chuck them in the garbage right now.

peak, um, no, you are just oblivious.

"The M1 money multiplier monitors the amount of money individuals and businesses have to spend on consumption or investment… relative to the money available for banks to lend."

you are still missing the fact that this is a RATIO.

it's growth in absolute levels that matters, not this ratio.

m1 is up even more than m2.

http://www.federalreserve.gov/releases/h6/current/

19% from a year ago.

the huge drop in the multiplier is just freddy and fannie buying up mortgages and the huge jump in the fed balance sheet.

0 points on question 2 as well.

this does not look like a test you are going to pass.

you are arguing that because the fed is growing it's balance sheet at 100% and banks get back the money the lend immediately from F+F, which is to say, the treasury, that a 10-19% increase in money supply didn't happen.

that does not make even the rudiments of sense.

seriously, stop and think for a minute.

let's say that banks have 100 to lend and businesses and consumers have 100.

the ratio is 1.

then, a year later, businesses and consumers have 119 and banks have 200.

sure, the ratio dropped, but money in circulation SOARED.

that is not a disinflationary environment.

that's like saying that because you gained 5 pounds and i gained 10 that you are losing weight.

Morganovich, you can't create money in a fractional reserve banking system when the money multiplier is 1 (unity) or less.

If the reserve ratio is 10%, then a $1 increase in the money supply creates $9 of new deposits.

However, if the reserve ratio is 100% or more (which is a money multiplier below 1, because MM = 1 / reserve ratio), then no money is created.

"Morganovich, you can't create money in a fractional reserve banking system when the money multiplier is 1 (unity) or less."

wow. you really do not understand this.

that is NOT the case at all.

at .79, $100 puts $79 out.

so, you could argue that 19% growth is only effectively 15%, but that's still very high growth.

you are mistaking the movement of a ratio with the movement of its components.

if we start with 100 red cars and 100 blue cars, and end with 200 red cars and 179 blue ones, the B/R ration dropped, but the number of blue cars was still way up.

Morganovich, that's not how it works. Banks don't shovel money into the streets to increase the money supply.

Bart, my inflation rate for health care (both monthly payments and co-payments) has been zero for years (although, some years I pay more in co-payments and some years I pay less, i.e. inflation and deflation).

So what. There are such things as outliers, even if you're telling the truth and your actual coverage and deductibles are actually apples to apples comparisons.

The bottom line is that even the lying/understated BLS medical stats show price increases of 3-4% per year, while insurance costs are going up at 8-10%

let's say that banks have 100 to lend and businesses and consumers have 100.

the ratio is 1.

then, a year later, businesses and consumers have 119 and banks have 200.

sure, the ratio dropped, but money in circulation SOARED.

that is not a disinflationary environment.

that's like saying that because you gained 5 pounds and i gained 10 that you are losing weight.

+1

The bottom line is that velocity has stopped falling per my work - and even via the Fed money multiplier.

And PT's assertion about not being able to expand money supply with a multiplier below one just shows he has a failure understanding basic math.

peak-

you clearly have no idea what that ratio means.

at .79, money creation is still very possible.

read bart's comment.

Bart and Morganovich, you're assuming each $1 increase in the money supply is being lent.

If each $1 is added to excess reserves, then no money is created.

The reality is banks built-up excess reserves:

Money Multiplier - Wikipedia

"This described growth in excess reserves has indeed occurred in the Financial crisis of 2007–2010, US bank excess reserves growing over 500-fold, from under $2 billion in August 2008 to over $1,000 billion in November 2009."

And there is no multiplier effect when the money multiplier is below 1.

And there is no multiplier effect when the money multiplier is below 1.

Horse puckey.

If Ben did a helicopter drop with a trillion (to illustrate how ridiculous your bogus, unproven and wrong assertion is), you'd see big inflation.

And your assumption that the multiplier is virtually 100% correct as calculated has zero basis in real economics.

Bart, 1 X 1 = 1

There's a difference between providing liquidity and creating money.

There's a difference between printing money and creating money.

Moreover, it should be noted, old loans that are paid-off and defaults destroy money, while there's no multiplier effect to create money.

Fiddle with and spin definitions all you like, your comment "there is no multiplier effect when the money multiplier is below 1." is incorrect, as incontrovertibly proven above (via common sense, etc).

And (again), the assumption that the multiplier is virtually 100% correct as calculated has zero basis in real economics, same with its correlation with the actual economic term called velocity.

And it continues to be so very "special" how you're running and hiding etc. from long term SS recipients standard of living going down, same with medical being ~6% of CPI and about 17% of GDP, etc. etc.

The incontrovertible facts speak for themselves.

Post a Comment

<< Home