What Tax Cut?

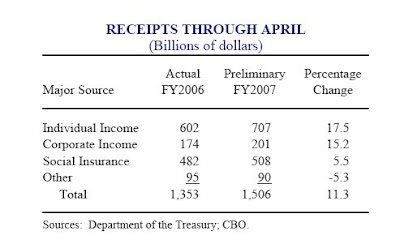

The Congressional Budget Office reported yesterday that through the first seven months of the fiscal year (Oct 2006 - April 2007), total tax revenues collected increased by $153 billion compared to the same period last year, an 11.3% increase. As the table above shows, individual income tax receipts increased by $105B (+17.5B) and corporate taxes increased by $27B (+15.2%), compared to the same period a year ago.

The Congressional Budget Office reported yesterday that through the first seven months of the fiscal year (Oct 2006 - April 2007), total tax revenues collected increased by $153 billion compared to the same period last year, an 11.3% increase. As the table above shows, individual income tax receipts increased by $105B (+17.5B) and corporate taxes increased by $27B (+15.2%), compared to the same period a year ago. We've heard a lot about the "tax cuts of 2003" (rates were decreased) when it was actually a "tax increase," if we look at what happened to revenues. In 2006, tax revenues were at all-time high of $2.4 trillion. At the current pace, tax revenues collected this year will be $2.67 trillion, and will set another record.

1 Comments:

This is an example of Dr. Arthur Laffer's idea about tax rate and tax revenue. Please reference the following websites or look up Laffer Curves.

http://www.gmu.edu/jbc/fest/files/Monissen.htm

http://www.frbatlanta.org/filelegacydocs/becsi.pdf

A question I have is that how do these numbers reflect price changes, wage changes and the changes in tax law that may have put limits on deductions available to the individual?

One thing Laffer's idea suggests is that fewer people will "dodge" taxes as rates get lower. The benefit gained from paying less taxes does not exceed the cost of not paying them (opportunity cost of time, cost of tax preparation, etc.). Laffer also points to Keynes's work as inspiration.

Post a Comment

<< Home